Tempo di lettura ca.: 7 minuti, 36 secondi

A solar tax credit is a financial incentive offered by the government to promote the installation of solar energy systems. In the US, it is sometimes referred to as the Investment Tax Credit (ITC) or the Residential Clean Energy Credit (RCEC).

A percentage of the cost of installing a solar energy system can be written off by individuals or corporations from their federal income taxes thanks to the tax credit. A credit equivalent to a portion of the eligible costs for a solar system was provided by the ITC.

Although the credit percentage changed over time, it usually amounted to about 30% for both commercial and residential solar installations. Because tax laws are subject to change, it’s a good idea to review the most recent guidelines for the current tax year.

How is the federal solar tax credit for 2024 calculated?

The solar tax credit reduces your federal income tax liability by a dollar for every dollar. Therefore, your tax responsibility would decrease to $9,000 if you had a $15,000 income tax obligation and received a $6,000 solar tax credit.

Will my tax refund be increased by the tax credit?

When you claim the federal solar tax credit, your tax refund could be higher based on your annual withholding and outstanding balance. What you owe for the year is lessened by the tax credit.

Therefore, you would receive the tax credit amount in addition to the refund you were initially scheduled to receive if you had previously deducted enough money from your paychecks to pay off your debt.

For example how the solar tax credit could impact a refund: Assuming a $20,000 solar investment, the tax credit is $6,000. Your refund would be $11,000 if you owed $20,000 in taxes but had $25,000 withheld from your paychecks during the year: $5,000 from income taxes and $6,000 from the federal tax credit.

But, the tax credit will not always be returned to you in the form of a refund cheque. The tax credit will only reduce your total amount owed if you failed to withhold enough income during the year to fulfil your liability.

What happens if the value of my tax credit exceeds my tax liability?

Since the Residential Clean Energy Credit is not refundable, your entire tax bill cannot be lowered to zero. Your tax liability will be zero if the amount of taxes you owe is less than the value of your solar tax credit.

However, this does not imply that you forfeit the remaining tax credit amount! What you owe the next year may be lowered by the balance of your credit. For instance, you would owe $0 in federal income taxes if your solar tax credit was worth $6,000 but your tax burden was only $5,000.

The $1,000 that remained would be carried over and applied towards your debt the next year. Although it may seem overwhelming to keep track of everything, don’t worry. There will be a record showing how much is available to carry over after the tax credit is applied to your taxes.

The majority of tax software will carry over the balance for you when you file your taxes again automatically. A schedule detailing the amount used and what will be carried over will also be included with your return for your tax preparer to see.

What is the value of the federal solar tax credit?

In 2024, the solar tax credit will cover 30% of the cost of installing solar panels. The tax credit value is typically approximately $6,000, whereas the average cost of solar installation is approximately $20,000. The cost of installing solar panels will determine the solar tax credit’s total worth. Based on the average cost of solar, the following table shows the expected tax credit values for solar systems of different sizes:

Size Of The SystemAverage Tax Credit Value

4 kW$3,600

6 kW$5,400

8 kW$7,200

10 kW$9,000

12 kW$10,800

12 kW$10,800

Will the solar tax credit expire?

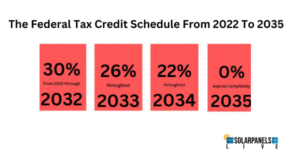

The 30% tax credit was and is still available until 2032 because of the Inflation Reduction Act. The value decreases to 26% in 2033. It declines to 22% once more in 2034 before running out in 2035.

For whom is the federal solar tax credit applicable?

Does ApplicableDoesn’t Applicable

installations on primary or secondary real estate, including houseboats, mobile homes, and condominiums

Installations on rental properties

Systems that are financed or bought with cash

Systems financed using a solar lease or PPA

U.S. TaxpayersCitizens without taxable income

initial equipment installation

Reinstallation of used equipment

The federal solar tax credit is eligible for the majority of Americans; however, some requirements must be fulfilled:

The solar system must be yours: In order to take advantage of the tax credit, you must pay cash or get a loan for the solar panels. If your solar panels are placed via a power purchase agreement (PPA) or solar lease, you will not be eligible for the tax credit.

One needs to possess taxable income: Your tax liability is decreased by the tax credit. You cannot immediately take advantage of the incentive if you have no tax liability. If your tax liability rises in the ensuing years, you might be entitled to carry over the credit.

It is necessary to install the solar system at either your primary or secondary residence: To be eligible for the Residential Clean Energy credit, you have to be the owner of the property. Properties that are rented out do not meet the requirements.

It needs to be reported at the time the device was first installed: You will not be able to get the tax credit back if you take down the panels and install them on another property.

Does the Residential Clean Energy Credit have an upper income limit?

The Residential Clean Energy credit has no upper income restriction. If the system qualifies and you owe taxes, you can claim the credit!

Which expenses qualify for the federal tax credit?

Eligible ExpensesIneligible Expenses

EquipmentAdditional projects (i.e., roof replacements)

Contract laborExtended warranty coverage expenses

Sales taxFinancing expenses

The federal tax credit pays for the majority of the expenses related to installing solar panels, including:

Equipment: The price of the inverters, racks, wiring, and solar panels.

Contract labour: The price of labour for setting up a site, installing equipment, organising a permission, inspecting, and planning.

Sales tax: The tax credit covers any sales tax related to the aforementioned expenses.

Nevertheless, the tax credit isn’t available for all expenses. Costs associated with roof replacements and extended warranty coverage are not covered by the tax credit. Most importantly, the tax credit value calculation does not account for financing costs.

The 30% Residential Clean Energy Credit is available for more than simply solar energy installations. Installations with solar panels, solar shingles, geothermal heat pumps, solar water heaters, fuel cells, and battery storage are all eligible!

How to submit a federal solar tax credit application?

It’s simple to apply for the tax credit! Three items are required when submitting a tax credit application:

On the IRS website, you can find Tax Form 5695.

The price of your installation, which you can find in your installer’s invoice or contract

The amount of taxes owed is indicated on line 18 of Form 1040.

Form 5695 and filling instructions can be downloaded from the IRS website if you are filing the tax credit on your own. It shouldn’t be too difficult to claim the credit because the guidelines are really straightforward.

If you use tax software, you will probably need to look for Form 5695 in the system, attach it to other tax documents, and enter pertinent data, such as the system’s price. The computations and determination of your ultimate tax liability will be handled by the software.

Using a tax preparer to file is also quite easy. They’ll take care of the rest for you; all you have to do is give them the cost of your system.

Does the federal tax credit combine with additional utility or local solar rebates and incentives?

The federal solar tax credit can be combined with any other solar incentive that is offered. Still, the kind of incentive may have an effect on the solar tax credit computation. Let’s investigate more closely.

Utility Rebates

Generally speaking, before the federal tax credit is computed, the amount of any utility rebate you receive will be deducted from your overall expenses. Your federal tax credit is worth less as a result, but you still get the extra incentive.

As an illustration, suppose you construct a $20,000 solar system and receive a $1,000 utility company refund. Rather than utilising the initial $20,000 cost for tax credit computation, the price would be the basis for subtraction of the utility rebate. It is $19,000 in this instance. To determine the amount of your tax credit that remains after a utility incentive, apply the following formula:

30% x Utility rebate amount – Total system cost equals the value of the federal tax credit.

State Solar Tax Credits

Similar to the federal tax credit, several states provide solar tax credits. Taxpayers’ state income tax burden will be decreased by the state tax credit, which is worth a specific proportion of the solar installation expenses. Your federal tax credit’s value is unaffected by a state tax credit.

You will report a different amount of taxable income on your federal taxes if you claim a state solar tax credit. Where state-specific solar tax credits are available is shown in the following table:

StateSolar Tax Credit

Arizona25% of costs, up to $1,000

Hawaii35% of costs, up to $5,000

IdahoDeduction of 40% of costs in year 1 up to $5,000, 20% in years 2-4

Massachusetts15% of costs, up to $1,000

New York25% of costs, up to $5,000

South Carolina25% of costs, max of 50% of tax liability in any given year, roll over unused credit for up to 10 years

Performance Based Rewards

Solar homeowners receive performance-based incentives that vary according to the amount of electricity generated by their solar system. Your federal tax credit’s value probably won’t alter as a result of these incentives. Your electricity bill may occasionally include a line item for these rewards, or your utility company may send you a separate payment.

A solar owner receives a certificate for each 1,000 kWh of solar energy they generate under certain states’ Solar Renewable Energy Credits (SRECs). You can then profit more by selling these to utilities or SREC aggregators. SRECs are occasionally available for purchase up front by the installer.

Should this be the case, you ought to speak with a tax expert about the potential effects on the value of your solar tax credit. Right now is the ideal moment to apply for the solar tax credit.

To take advantage of the entire 30% tax credit, you have roughly ten years. However, you don’t have to wait ten years just because you can. Investing in solar energy early on is almost always a smart move.

As soon as you install solar, you can start saving money earlier and stop paying astronomical electricity bills. You can then use the money you save for the things that are truly important to you. In addition, switching to solar power is now the best investment you can make.

The federal tax credit may not expire until far earlier than local solar incentives. Consider net metering, an incentive that reimburses you for the entire cost of power for any solar energy you feed into the system. Across the nation, utilities are shifting away from net metering and decreasing the amount they charge solar energy users for their electricity.

To ensure you receive the maximum solar savings, you should install solar before benefits like net metering and utility rebates start to run out. Kindly note that the solar system and the taxpayer must fulfil certain qualifying requirements as stated in the tax code in order to be eligible for the solar tax credit.

The price of solar panels, installation, and associated equipment are typically included in the list of eligible expenses. It is advised to speak with a tax expert or review the most recent data from pertinent government agencies to comprehend the specifics and present state of solar tax credits in your area.

Federal Solar Tax Credit FAQ

What is the value of the federal solar tax credit?

Thirty percent of the cost of solar installation is the federal tax credit that will apply in 2024. The actual tax credit you receive is contingent upon the cost of installation; the average tax credit amount is approximately $6,000.

When can I submit a solar tax credit claim?

When you file your taxes for the year the solar system was installed, you claim the tax credit. Therefore, you would apply for the tax credit when you file your taxes for the year in 2023 if you installed solar in 2022. The year that the panels are installed must be used to file for the tax credit. If you missed the deadline for claiming the tax credit, you can still receive it by filing an amended return.

Is it possible to combine a solar loan with the solar tax credit?

If you took out a loan to pay for your solar energy system, you can use the solar tax credit! In order to keep your loan payments low, many solar loans require you to pay the entire tax credit amount on your loan before the 18-month mark. Your loan installments will go up if you don’t. Therefore, make sure you have the funds available to pay off the loan after the allotted 18 months have passed.

Which kinds of real estate are eligible for the federal tax credit?

The federal tax credit may be claimed for solar panels placed on houseboats, mobile homes, and condominiums, provided that both the installation and the borrower fulfil all other eligibility requirements. The solar tax credit is also available for off-grid solar installations! I have a rental property.

Can I get the tax credit for solar installations?

No, unless you also reside in the building, you are not eligible to claim the Residential Clean Energy Credit on rental properties. On the other hand, the commercial solar tax credit (IRC Section 48) can apply to your rental property.

Can I use my vacation home to qualify for the tax credit?

Indeed, you are eligible to receive a tax credit for installing solar panels on secondary homes. However, to find out if your holiday property qualifies, check with your tax provider.

Does the federal tax credit apply to battery storage systems?

Whether or not battery storage is coupled to solar panels, it is eligible for the federal tax credit. Batteries were previously only acceptable when they were a part of an approved solar system. However, since the IRA was approved, standalone batteries are now eligible for the tax credit as well.